Aggregate supply and factors influencing it. Aggregate supply and factors determining it Aggregate supply and factors determining it

Aggregate supply (AS) is the total quantity of final goods and services that can be supplied to the economy at different price levels. The concept is often used synonymously with gross national product.

Let us first dwell on the simplest graphical interpretation of the aggregate supply curve AS, which reflects changes in the real volume of production, or output, in connection with changes in the general price level.

The positive slope of the AS curve is associated in economic theory with the effect of production costs. The AS configuration reflects rising unit costs as GDP increases. At low GDP levels, when the economy is far from full employment, the pressure of production costs on prices is not so great. But as we approach the level of potential GDP, there are fewer and fewer unemployed resources, therefore, with the attraction of additional factors of production, the costs of paying for them increase. These costs represent increasing costs of production and therefore must be offset by rising price levels.

Aggregate supply is a model, represented in the figure as a curve, which shows the level of cash real exchange of production at each possible price level. Higher price levels create incentives to produce more goods and offer them for sale. Lower price levels cause a reduction in the production of goods.

There is great disagreement about nature and firm aggregate supply curve.

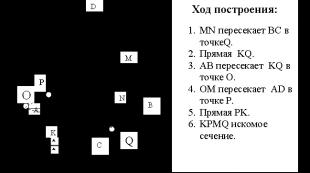

The curve consists of three defined segments:

1 – intermediate (deviating upward);

2 – Keynesian (horizontal);

3 – classic (vertical).

The shape of the aggregate supply curve reflects changes in unit costs can be calculated by dividing the cost of total inputs used by the volume of output. In other words, the cost per unit of output at a given level of output is the average cost for a given volume of output.

Intermediate (ascending) segment. Between Q and Qf, an increase in real national output is accompanied by an increase in the price level. Reasons: first, the entire economy practically consists of countless markets for goods and resources, and full employment occurs unevenly and not simultaneously in all sectors or industries; second, some industries may experience shortages and other production bottlenecks; Third, expanding production also means that when production reaches full capacity, some firms will have to use older, less efficient equipment. As production increases, less skilled workers are hired. For all these reasons, unit costs increase and firms must charge higher prices for goods in order to produce profitably. Therefore, the intermediate period is accompanied by rising prices.

Keynesian segment. In the graph, Qf denotes the potential level of real national output at full employment. Let us remember that the natural rate of unemployment arises from the volume of the national product. Full employment does not mean the absolute absence of unemployment. Economists consider frictional (associated with searching for or waiting for work) and structural (over time, important changes in the structure of consumer demand and technology occur, which in turn change the structure of overall labor demand) unemployment are completely inevitable. Therefore, the unemployment rate or the natural rate of unemployment at full employment is equal to the sum of the frictional and structural unemployment rates.

Note that the horizontal segment of the aggregate supply curve includes real national output, which is significantly less than national output at full employment. Consequently, the horizontal segment indicates that the economy is in a state of deep recession, depression and that a large number of machines, equipment, and labor are not used. These untapped resources can be put into action without putting any pressure on the price level. Workers who have been unemployed for two to three months are unlikely to expect an increase in wages when they return to their jobs. Since producers can purchase resources at fixed prices, production costs do not increase during expansion, and therefore there will be no reason for the prices of goods to rise. And vice versa, if the real volume decreases, then prices for goods and resources will remain at the same level. According to Keynesians, once full employment is reached, the aggregate supply curve becomes vertical at point Qf.

Classic (vertical) segment. At point Qf, the economy is at a point on its production possibilities curve where it is impossible to achieve further production growth in the short term. This means that any further increase in prices will not lead to an increase in real volume, since the economy is already running at full capacity. At full employment, individual firms may try to expand production by bidding higher prices on inputs than other firms. but the resources and additional volume of product that one firm will receive will be lost by the other. As a result, the prices of resources and, ultimately, goods increase, but real output remains unchanged.

It should be noted that, firstly, this segment considers classical economic theory, in accordance with the conclusions of which, due to certain forces inherent in a market economy, complete dependence becomes the norm. secondly, “full employment”, “the real volume of national output at full employment” are not unambiguous concepts, since the working day and the size of the labor force can sometimes increase beyond normal limits.

By analogy with the concept of “aggregate demand,” we can distinguish an aggregate indicator that will reflect the supply side in the national market. We are talking about the category “aggregate supply”. Aggregate offer- the real volume of production in the economy (GDP) that producers are willing and able to offer at each possible price level. Economists argue about the shape of the aggregate supply curve. Typically, the aggregate supply curve is presented in the form of three segments, reflecting the relationship between the price level and the amount of aggregate supply. This relationship can be shown graphically.

On the AS chart, three segments can be distinguished: I - horizontal, or Keynesian, segment; II - vertical, or classic, segment; III - ascending, or intermediate, segment.

For Keynesian segment A typical situation is when the maximum possible volume of national production Qmax has not been achieved. It is obvious that there is an underutilization of production capacity and significant unemployment, i.e. the economy operates under conditions of underemployment and is in a crisis or depression phase of the economic cycle. While in a state of crisis or depression, the economy can increase production volumes without a noticeable increase in prices for manufactured products. An increase in production volumes in the segment up to Q t with practically zero price growth is possible through the use of free economic resources, which, due to the crisis in the economy, “fell out” of the process of social reproduction. All these resources can be involved in production at constant resource market prices. And since entrepreneurs purchase economic resources at fixed prices, their costs of producing a unit of output do not increase as output expands. The level of production costs per unit of production does not actually change, which means that the prices for the goods created will be constant.

Classic site The aggregate supply schedule assumes that the economic system has reached its production possibilities curve, that is, it operates under conditions of full employment of all economic resources. This means that the maximum possible volume of domestic production Q max (GDP patent) has been achieved for a given economy. Thus, the economic system is in the upswing phase of the business cycle. In this area, any change in the price level in the economy will not lead to a change in the real volume of production in the economy.

For your information. The classical portion of the aggregate supply curve was studied by classical economists. According to classical economists, a market economy is characterized by a state of full employment, which is achieved automatically.

Intermediate segment graph AS reflects the situation of a parallel increase in both production volumes and the price level in the economy (the indicators change accordingly from Q 1 to Q max and from P 1 to P 2). Such joint dynamics of these two indicators can be explained by the following reasons. Firstly, the uneven development of the national economy across industries and regions. Full employment is achieved unevenly - in some sectors there may be a shortage of resources, in others, on the contrary, there will be a surplus. The latter will experience stagnation. In the first group of industries, an increase in demand for resources will be accompanied by an increase in prices for production factors, and, consequently, an increase in average costs and prices for finished products. In another group of industries, average costs remain constant. Secondly, the growth of production volumes in the interval from Q 1 to Q max requires the involvement of more and more previously unoccupied economic resources in the reproduction process. As we move forward and approach Q max, the quality of these resources decreases, i.e., they are less productive (than, for example, in the Keynesian sector, when the highest quality and most suitable economic resources were attracted to increase production). Consequently, an increase in production volumes will be associated with rising costs, and consequently, with rising prices.

Until now, the analysis has not taken into account non-price factors of aggregate supply, but has studied the relationship between the price level in the economy and the real volume of products produced in society. The action of non-price factors leads to changes in aggregate supply.

Line AS can change its position on the plane under the influence of non-price factors.

If it shifts to the right, then aggregate supply is said to increase. In this case, at the classic and intermediate stages, there actually is an increase in production volumes at each possible price level. In the Keynesian segment, the price level decreases at each level of production in the economy. If the AS curve shifts to the left to position AS 2, then aggregate supply decreases.

The main non-price factors of aggregate supply have one common property - any shift in the AS curve is always associated with a change in the cost of producing a unit of output. The main non-price factors of aggregate supply include:

1. Current prices for economic resources. An increase in resource prices leads to an increase in production costs, therefore, aggregate supply will decrease and the AS schedule will shift to the left. It should be noted that the price level for economic resources, in turn, also depends on a number of factors. In particular, we can mention the availability of internal resources in the country. As their number increases, the society's CPV will shift to the right, and the AS schedule will shift in the same direction (the aggregate supply will increase). Prices for imported resources and their fluctuations, the degree of monopolization of factor markets, the efficiency of use of economic resources and other factors can affect resource prices and average production costs, and therefore aggregate supply.

2. The level of productivity of economic resources and the effectiveness of the technologies used. Resource productivity is defined as the relationship between an economy's output and resource inputs. If resource productivity increases, then average costs decrease and aggregate Supply increases. The productivity of economic resources depends on many factors - the quantity and quality of other resources, the level of production technology, specialization of resources, the level of qualifications of the workforce, and features of economic management. The introduction of new technologies increases the productivity of production factors and reduces unit costs. This contributes to the growth of aggregate supply, its graph will shift to the right.

3. Level of taxes, subsidies and subsidies. An increase in taxes on the business sector will lead to a decrease in profits. The natural consequence of this will be a reduction in aggregate supply - the AS schedule will shift to the left. Conversely, subsidies and grants to business from the state budget will reduce production costs and stimulate the growth of aggregate supply - the AS graph will shift to the right.

4. Measures of state regulation of the economy. As a rule, the expansion of government participation in economic life is accompanied by an increase in firm costs and a reduction in aggregate supply. This will be most clearly manifested in the case of direct administrative intervention of the state in the economy.

For your information. The impact of non-price factors on aggregate supply will be accompanied by a shift in the AS curve. At the same time, they talk about a change in aggregate supply. If we are talking about price factors (i.e., changes in the price level in the economy), then the amount of aggregate supply will change. The position of the AS graph on the plane will not change here, but the combination “price level in the economy - the volume of GDP offered for sale” will change.

In other words, this is the real volume of national production at various values of the price level for final goods and services.

The dependence of the real volume of national production (product) on the price level is called aggregate supply curve.

The nature of the influence of the price level on the volume of national production and, consequently, the shape of the aggregate supply curve depends on the duration of the period under consideration.

In macroeconomics (as opposed to microeconomics), the main criterion for dividing into short-term and long-term periods is price flexibility, rather than the stability of the capital stock. In the long run, nominal prices for goods and resources are flexible, i.e. manage to adapt to each other, change in the same proportion. In the short term, prices do not have such flexibility. This period is characterized by rigidity of nominal prices.

The proportional increase in prices for goods and resources in the long run is explained as follows:

1) an increase in aggregate demand leads to an increase in the average price level (we will prove this later using the example of the “ AD – AS"). As a result, the cost of living for all categories of workers rises. If, under these conditions, the value of nominal wages does not increase, then the value of real wages will begin to decline, and workers will begin to insist on increasing nominal wage rates in order to maintain the achieved standard of living. At the same time, the income of firms as a result of rising prices will increase sharply and they will be able to increase wages for their employees in the same proportion as the prices increased. If enterprises do not do this, they will lose part of their qualified and most mobile workforce;

2) many types of products are both finished goods and resources. For example, sand and clay are finished products for a quarry, and raw materials for brick factories. In conditions of rising prices for raw materials, the company's costs will increase in the same proportion. In order not to reduce production volumes, the company is forced to raise prices for its products in the same proportion.

The aggregate supply curve has a positive slope because When the price level rises, producers will generally be inclined to increase production volumes. The configuration of the aggregate supply curve is somewhat different from the configuration of the supply curve. In addition, there is no consensus regarding its configuration. It is interpreted differently by the classical and Keynesian schools.

The differences between the classical and Keynesian schools on this issue are as follows:

1) these schools characterize the economy in different time intervals. Classicists analyze the economy in the long term, and Keynesians - in the short term;

2) when analyzing equilibrium at the macro level, these schools answer the main question differently: to what level of employment and use of production potential does the equilibrium volume of production correspond, and how fully are the resources available to society used under conditions of macroeconomic equilibrium?

Let's start analyzing the aggregate supply curve.

Economy-wide, three different situations can arise:

1) state of underemployment;

2) a state approaching the level of full employment;

3) the state of full employment.

Therefore the curve AS(Fig. 2.4) consists of three sections: horizontal (corresponds to the 1st state), intermediate (corresponds to the 2nd state), vertical (corresponds to the 3rd state). The horizontal segment is called Keynesian, and the vertical segment is called classical. This is due to the interpretation given by the Keynesian and classical schools regarding the interdependence between real GDP ( Y) and price level ( R).

Rice. 2.4. Aggregate Supply Curve

On horizontal segment(1) real GDP growth from 0 to Y 1 not accompanied by price increases. According to the Keynesian approach, this characterizes an economy that is in a depressed state, so an increase in aggregate demand only leads to an increase in real GDP to the level Y 1 without price increases.

The rigidity (constancy) of prices is explained by the following. In conditions of depression, resources are not fully used, most machines and mechanisms are idle, and unemployment is high. During this period, an increase in production volumes is possible due to the involvement of previously unused factors in production without changing prices, since suppliers of physical capital will not demand an increase in rental rates for capital services, workers who were previously unemployed for several months will not demand an increase in wages and etc.

Intermediate segment(segment 2, it is often, like the horizontal, called Keynesian) characterizes a part-time economy where prices and wages are relatively flexible. In this area, the growth in real output from Y 1 before Y* accompanied by rising prices. The economy is approaching potential GDP ( Y* is GDP in conditions of full employment of all resources or the natural level of production), so-called “bottlenecks” begin to appear in it.

In some industries, all labor resources and production capacities are already used, while in young, dynamically developing industries there is a shortage of them. In such a situation, in order to expand the volume of real GDP, it is necessary to increase prices for production factors in order to attract additional labor resources into production and attract suppliers of machinery, equipment, raw materials, etc. In addition, in many industries, to increase production output, obsolete equipment is used, which leads to increased costs.

Thus, an increase in the price of labor and prices for other resources will entail an increase in costs per unit of production, and in order to maintain the same level of profitability, firms are forced to increase the prices of their products.

Vertical section(3) demonstrates the classical school's view of aggregate supply. In this area with a volume Y* full employment of resources has been achieved in society (it should be noted that full employment is not one hundred percent, but the optimal employment of resources at a given level of economic development). The economy is running at full capacity, prices and wages are completely flexible. However, any increase in prices does not lead to an increase in production.

If the economy has reached its potential level, then firms no longer have the opportunity to expand production, since there are not enough resources to increase production volumes. In this situation, producers have only one reaction - increasing prices, leading to an increase in the general price level. In conditions of rising prices, some firms can offer higher prices for resources, and at the same time increase output, while others cannot, they are forced to reduce output. As a result, prices rise, but the real production volume remains unchanged at the potential level ( Y* ).

Thus, any attempts to stimulate the economy in this period without expanding resource restrictions will only lead to higher prices.

From the above it follows that the curve AS reflects the dynamics of production costs per unit of production due to changes in the price level. Costs do not change on the horizontal segment, but grow on the intermediate and vertical segment (prices for resources rise, wages rise).

Of course, the Keynesian and classical segments are abstractions based on the assumption of absolute rigidity and flexibility of prices. But such abstractions are useful for exploring different approaches to aggregate supply and to macroequilibrium analysis.

The above curve configuration brought together alternative views. The Keynesian case in its extreme version means a horizontal line (Fig. 2.5 a). The so-called normal Keynesian case means a positive slope of the curve AS(Fig. 2.5 b). The classic segment is depicted by a vertical line emanating from the point corresponding to potential GDP ( Y* ).

Rice. 2.5 Alternative views on curve configuration AS

The horizontal segment is also called short-term, since Keynesian theory views the economy in the short run, when the flexibility of prices and wages is limited. During this time period, collective agreements are not revised for a certain period, so wages remain unchanged. Consequently, costs do not rise and the price of firms' products does not rise. As a result, the general price level remains unchanged.

The normal Keynesian case also applies to the short run, but here an assumption has already been made about the relative flexibility of prices compared to nominal wages. In such a situation, with an increase in the price level and rigidity of nominal wages, real wages decrease, and it is profitable for firms to expand the demand for labor. There is an increase in output and an increase in the price level.

The vertical or classic section is more applicable to long-term analysis, because in the long run, prices can change more easily and the economy moves toward full employment. Over the course of several years, collective agreements are usually revised, resulting in higher wages and, consequently, higher prices for the firm's products. As a result, the general price level rises. This flexibility of the price mechanism allows the economy to operate at the level of potential GDP ( Y* ).

It should be noted that in the Keynesian model the curve AS is limited on the right by the level of potential output, after which it takes the form of a vertical straight line, i.e. coincides with the long-term curve AS. Thus, the volume of aggregate supply in the short run depends mainly on the amount of aggregate demand (according to Keynes, aggregate demand creates supply), since if the government wants to increase the volume of production in the economy, then, according to the Keynesian approach, it must stimulate aggregate demand.

When analyzing the curve, it is necessary to take into account non-price factors that shift the curve. Non-price factors include:

changes in prices for factors of production, raw materials, energy. Thus, their rise in price leads to a reduction in supply. Curve AS will move to the left to position AS 1 , and a decrease will lead to a shift to the right - AS 2 (Fig. 2.6);

changeproductivity: Increased productivity leads to lower costs and increased supply. In this case the curve AS moves to the right to position AS 2 , and vice versa (Fig. 2.6);

state policy:

a) taxes. An increase in taxes leads to a decrease in supply, the curve AS moves to the left to position AS 1 , and the provision of subsidies, on the contrary, increases supply, the curve AS moves to the right - AS 2 (Fig. 2.6);

b) government regulation: a regulated economy increases the volume of clerical work and, therefore, costs rise and supply decreases, the curve AS moves to the left to position AS 1 (Fig. 6);

4) if the state’s economy is heavily dependent on agriculture or tourism, then the shift in the aggregate supply curve is affected by weather conditions;

5

AS 1 AS AS 2 ASAS2

Rice. 6. Shift in the aggregate supply curve

Rice. 6. Shift in the aggregate supply curve

Exogenous factors unexpected by economic agents that cause shifts in the aggregate supply curve, both to the left and to the right, are called supply shocks. They can be caused by increased prices for resources (in particular oil), natural disasters (leading to the loss of some resources and a decrease in potential), increased activity of trade unions, changes in legislation, and increased costs for environmental protection.

In economic theory, aggregate supply is the sum of all final goods and services produced in a country that firms are willing to offer on the market during a certain period at each possible price level. Higher price levels maintain incentives to produce more goods and offer them for sale. Lower price levels cause a reduction in production and supply of goods. The relationship between the price level and the volume of the national (domestic) product is direct (“positive”).

The AS curve reflects the change in unit costs as national output increases or decreases. Costs per unit of output can only be calculated conditionally by dividing the cost of total resources used by the cost of the volume of national production. In other words, the cost per unit of output at a given level of output will represent the national average cost.

The dependence of the real volume of national output on the price level is called the aggregate supply curve. It consists of three sections:

- 1) horizontal (or Keynesian), when the national product changes but the price level remains constant;

- 2) vertical (or classical), when the national product remains constant at the level of “full employment”, and the price level can change;

- 3) intermediate, when both the real volume of national production and the price level change.

Supply in the short term.

The horizontal segment of the AS curve characterizes the state of national production in the short term, when prices for many goods are inflexible. It's connected:

- 1.) with the dissemination of information about list prices for the near future;

- 2.) it is assumed that there are unused human and material resources, i.e. labor and capital.

The availability of resources indicates that it is possible to expand production at the established price level without putting any pressure on them. If during this period the volume of the national product begins to increase, then neither shortages nor “bottlenecks” in production causing an increase in prices arise. Entrepreneurs can purchase labor and other resources at fixed prices, which allows them to keep production costs at the same level and, therefore, not increase prices for goods. If real production begins to decline, then prices for goods and resources will remain at the same level. This means that while real national output declines, commodity prices and wages will remain unchanged.

Suppose that in order to achieve maximum national output on the horizontal segment of the AS curve, significant previously unused resources were used at fixed prices. Further increase in national production is possible only if additional available free resources are attracted, which have a lower degree of return, productivity, and efficiency. This will cause an increase in production costs, which will certainly require an increase in the price level so that the use of these resources is profitable.

Offer in the medium term.

Considering the fact that the national market includes many markets for goods and resources, and full employment is formed non-simultaneously and far unevenly. This can create deficits and other “bottlenecks” in social production, which often have to be “solved” through additional costs and efforts. At the same time, the rise in prices to a new higher level opens up the possibility of using less and less efficient resources, which will clearly lead to a decrease in the national economic level of profitability of social production. Therefore, in the intermediate segment of the AS curve, an increase in real domestic (national) product in the medium term is accompanied by an increase in prices.

Long-term supply.

When all available resources are fully utilized and there is full employment of the labor force, then further expansion of social production is impossible due to the fact that the limited resources available are exhausted. This state of the national economy from the side of aggregate supply is characterized by a vertical segment of the AS curve in the long run. This means that national production and aggregate supply have become fixed and do not depend on the price level.

The vertical segment of the AS curve corresponds to the views of the classical economic school and its followers - the neoclassicals, from the point of view of which the market economy has sufficient internal self-regulation mechanisms to ensure constant full employment. Consequently, this segment AS symbolizes the complete independence of aggregate supply from the price level and aggregate demand and complete predetermination from the technical and production capabilities of the national economy.

However, the proposed logic of changes in the conditions of social production in the process of transition from the short-term period (horizontal segment) to the medium-term (intermediate segment) and then to the long-term period (vertical segment) indicates, to one degree or another, the functional dependence of aggregate supply on the price level at the immutability of all other circumstances and factors.

The difference between the short and long term in macroeconomics is associated mainly with the behavior of nominal and real quantities. In the short term, nominal values (prices, nominal wages, nominal interest rates) change slowly under the influence of market fluctuations and are “rigid”. Real values (output volume, employment level, real interest rate) change significantly and are considered “flexible”. In the long run, the situation is exactly the opposite.

The entire set of factors influencing changes in aggregate supply belongs to non-price factors and, therefore, causes a shift in the AS curve. This shift indicates changes in the cost of production per unit of national output. At the same time, an increase in production costs per unit of product causes a shift of the AS curve to the right, and their reduction - to the left.

Non-price factors of aggregate supply include:

- - changes in prices for resources;

- - availability of internal resources;

- - prices for imported resources;

- - market dominance;

- - change in productivity (production volume/total costs);

- - changes in legal norms;

- - taxes on enterprises and subsidies;

- - government regulation.

The most significant non-price factors of aggregate supply include changes in prices for resources, changes in their productivity, and changes in legal norms.

As for changes in the domestic resources available to society, an increase in their supply entails a reduction in production costs and, accordingly, an increase in the volume of the national product. Conversely, their reduction causes a reduction in the supply of resources and an increase in their prices, which affects the decrease in the volume of national production. If a country uses imported resources, then the latter, through the level of prices for them, have the same impact on aggregate supply as the dynamics of prices for domestic resources. However, in this case it is necessary to make an adjustment for the ruble exchange rate. If it falls, then prices for imported resources for domestic producers will rise. This will cause an increase in production costs - the AS curve will shift to the left.

The main resources (factors) of production are labor, capital and land. Labor has the most significant impact on national production, since it accounts for * all costs of producing the national product. Therefore, the state of the labor market and the price level on it largely depend on the social costs of production and the possibility of increasing the volume of social production.

The impact of capital on aggregate supply is determined by the level of savings, the scale of capital accumulation, its technological and reproductive structure and qualitative condition. Increased savings and capital formation provide favorable conditions for investment, production growth and aggregate supply. The qualitative state of capital is characterized by the level of advanced equipment and technologies used in social production.

The technical structure of capital (fixed assets) is characterized by the ratio of passive and active means of labor in the total capital, i.e. shares of machinery and equipment and shares of buildings and structures in social capital.

The reproductive structure of capital (fixed assets) is characterized by the ratio of the shares of financial resources allocated for restoration, reimbursement of consumed capital and its expansion, i.e. ratio of gross and partial investments. However, in the conditions of accelerated scientific and technical progress, one must remember about the qualitatively new function of depreciation charges, the function of the accumulation fund.

Expanding the supply of natural factors thanks to land reclamation, new agricultural techniques, discovery of minerals, and new technologies for their extraction leads to a reduction in costs and an increase in total supply.

Directly related to the resources considered is productivity as the result of the organizational and managerial interaction of the productive forces of society, which is expressed in the real volume of production per unit of resource input. It is associated with a reduction in production costs, obtaining a large volume of national product with the same resources, and this increases aggregate supply - the AS curve shifts to the right.

The dominance of certain market structures in the national economy, and, above all, in resource markets, significantly influences national production and aggregate supply. In particular, monopolies and dense oligopolies create a real possibility of imposing prices that significantly exceed the prices of a perfectly competitive market, which can have a restraining effect on the growth of national production.

Changes in the legal regulations under which all businesses operate can change costs and shift the AS curve. In particular, an increase in taxes on enterprises, a resource tax, and a social security tax causes an increase in total and unit costs and a reduction in aggregate supply. Business subsidies (direct financial support from the government for businesses) reduce production costs and increase aggregate supply.

In assessing the role of government regulation within the framework of aggregate supply analysis, points of view differ. Some consider it an indispensable attribute of a market economy in conditions of the dominance of imperfect market structures, which reduces total social costs and helps to more rationally distribute and use available resources. Others vehemently advocate deregulation, arguing that increasing efficiency and reducing the cost of maintaining the relevant apparatus allows reducing the costs of social production. Conversely, increased regulation will increase production costs and reduce aggregate supply.

Aggregate offer- this is the amount of goods and services presented by all producers on the market, the sum of individual offers of all economic entities. Aggregate supply is an abstract model that characterizes the real volume of production at a given price level. The dependence is expressed as follows: an increase in prices stimulates an increase in the production of goods, and a decrease in prices is accompanied by a decrease in production volume. Thus, a direct relationship between these factors is revealed. As for the shape of the aggregate supply curve, despite the disagreements among economists, the most accepted form is one that includes three segments: Keynesian (horizontal), intermediate (upward) and classical (vertical). For clarity, let's build a graph:

Rice. Aggregate Supply Curve

- on the horizontal, or Keynesian, segment, the national product changes, but the price level remains constant

- on the vertical, or classical, national product remains constant, but the price level changes

- in the intermediate period, both the real volume of production and the price level change

Let us analyze three segments of the aggregate supply curve. The segment q1 denotes the potential level of real output at full employment. With this volume of national product, a natural level of unemployment arises. The potential nature of the level of real output is expressed in the fact that the horizontal segment reflects a production volume that is significantly less than at full employment. At the same time, the economy is in a state of deep crisis, there is a huge underutilization of production capacity, and the labor force is inactive. These unused resources can be put into action without changing the price level, because the workers, drawn into production from a state of unemployment, do not yet think about demanding higher wages. Machines, raw materials, equipment can be purchased at consistently low prices. Consequently, production costs will remain at the same low level, and production will begin to expand. This state of production was analyzed by J. Keynes after the Great Depression of 1929-1933, when unemployment in many countries reached 25%. In this situation, it is possible to expand production without fear of increasing production costs and rising product prices. This conclusion deserves serious analysis and application in the current economy.

The classic (vertical) segment characterizes the state of the economy when all production capacities are loaded (potential GNP has been reached), full employment of the population and a sufficiently high price level are observed. Such a state, according to the classics, can only arise thanks to "invisible regulatory hand" market.

The intermediate (ascending) segment is characterized by a simultaneous movement of real output to the right and the price level upward. This situation is possible due to the uneven development of individual firms and sectors of the national economy: some industries develop with advanced technology and full employment, others are forced to operate outdated equipment and hire unskilled workers, which increases production costs and the price level. It is these factors, acting on the intermediate segment of the aggregate supply curve, that lead to the simultaneous movement of both real output and the price level.

The aggregate supply curve presented in the figure has a purely theoretical meaning. As for practice, it is very contradictory, and therefore it is no coincidence that there are many contradictory interpretations of the content of this curve.

Non-price factors of aggregate supply

These include resource prices, increases or decreases in labor productivity, and changes in legal regulations. Before proceeding to characterize each of the factors, let us depict the process of their interaction graphically. The action of non-price factors leads to a shift in the aggregate supply curve AS1. If aggregate supply increases, then it shifts to the right to position AS2, if it decreases, then it shifts to the left, to AS3:

Rice. Changes in Aggregate Supply

An important non-price factor is the price of resources (as opposed to the price of finished products). When resource prices rise, unit costs increase, which reduces aggregate supply. If resource prices fall, the reverse process occurs. The most important types of internal resources are land, labor, capital and entrepreneurial abilities. In addition to these domestic resources, prices for imported resources also apply. Dominance in the market can also be attributed to resource potential.

The next non-price factor is labor productivity. In foreign economic science, it is calculated as the ratio of the real volume of production to the amount of resources used. We can say it differently: productivity is an indicator of the average volume of output per unit of cost. If productivity increases, it means that a larger volume of output is produced from the same resource potential and, therefore, aggregate supply increases, and the curve on the graph shifts to the right.

Aggregate supply is also affected by changes in legal regulations. It may concern either taxes or subsidies. If the tax system is tightened, costs increase and aggregate supply decreases; if taxes are reduced, costs decrease and aggregate supply increases. If we are talking about subsidies, we mean direct government payments to businesses or lower tax rates. Both reduce costs and, therefore, stimulate the growth of aggregate supply.

The amount of costs is influenced by government regulation. It, as a rule, increases them and therefore acts as a factor counteracting the activation of aggregate supply.