The role of modeling in predicting relationships and structures. Modeling Main types of models

Let's consider various methods of modeling, forecasting and planning in general. Currently, according to scientists, there are about 150 different modeling and forecasting methods, but in practice only 15-20 basic ones are most often used (Fig. 1.3.1). Let us give brief characteristics of the main methods. The main idea of the expert assessment method is that the intuitive-logical thinking of individual experts within the framework of special procedures is combined with quantitative methods for assessing and processing the results obtained.

Extrapolation forecasting methods involve forecasting one- and multidimensional series. The essence of extrapolation methods is to study and transfer to the future the existing trends in the development of the system. In order to predict one- and multivariate series, some statistical research methods are also used, which are based on the assumption that the levels of a time series consist of the sum of several components, reflecting a pattern or randomness of development.

Among the economic and mathematical methods, one can highlight the inter-industry balance method, the correlation-regression method, and various optimization methods (for example, the simplex method). Note that econometric models have a number of advantages compared to input-output balance models. In particular, econometric models require little time to prepare data; they are characterized by the ability to reflect various aspects of the functioning of the economy and relatively simple formal methods.

The essence of the method of economic analysis is that an economic phenomenon or process is divided into parts, then the relationships of these parts with each other are identified, and the impact of the identified interactions on the process as a whole is assessed.

The essence of the balance method is to link the needs of an administrative-territorial unit for various types of products, resources with the production capabilities of the administrative-territorial unit, sources of resources, etc.

The normative method, rather, refers to planning methods and is associated with the use of various norms or standards when drawing up a plan or forecast.

Note that in different sources the essence and name of modeling and forecasting methods can be reflected in different ways.

Rice. 1.3.1. System of models and methods for forecasting nomu. For example, it talks about the existence of genetic and normative forecasting. The goal of genetic forecasting is to find the most likely proportions and rates of industrial development, while the goal of normative forecasting is to find ways and timing for achieving the set goals.

Modeling and forecasting methods can be used in various cases. For example, when forecasting city budget data and constructing medium-term forecasts of budget revenues, most countries and most territories use econometric models.

Since the work examines the possibilities of forecasting for the medium and long term, the specifics of using these methods may be different. The longer the forecast period, the less important quantitative forecasts become and the more important qualitative forecasts become. Due to the insufficient amount of accumulated statistical data reflecting the functioning of Russian regions in market conditions, it is quite difficult to develop a good quantitative forecast for 10-15 years in advance.

comparison table

| Tool name | Scope of application | Implemented models | Ready for use | |

| general purpose | basic knowledge of statistics | |||

| Statistica, SPSS, E-views | research | boxed product | ||

| Matlab | special mathematics education | programming required | ||

| SAP APO | business forecasting | algorithmic | ||

| ForecastPro, ForecastX | business forecasting | algorithmic | no deep knowledge required | boxed product |

| Logility | business forecasting | no deep knowledge required | requires significant modification (for business processes) | |

| ForecastPro SDK | business forecasting | algorithmic | ||

| imitation |

Forecasting success

·

·

·

Main directions and methods of forecasting

The main forecasting methods include:

Statistical methods

- Statistics is a branch of knowledge that deals with general issues of collecting, measuring and analyzing mass statistical (quantitative or qualitative) data. Statistics as a science includes sections: theoretical statistics (general theory of statistics), applied statistics, mathematical statistics, economic statistics, econometrics, legal statistics, demography, medical statistics, technometrics, chemometrics, biometrics , scientometrics, other industry statistics, etc.

Expert methods

- Application area. Economic conditions. Solving problems of scientific and technological progress. Development of objects of great complexity.

- For an object whose development does not lend itself to substantive description or mathematical formalization. In the absence of reliable statistics regarding the control object. In conditions of great uncertainty. In the absence of a computer. In extreme situations.

- Features of application. According to expert estimates, 7-9 specialists. Development of a collective opinion of a group of experts. It takes a lot of time to poll and process data.

Expert assessment- the procedure for obtaining an assessment of the problem based on the group opinion of specialists (experts). A joint opinion is more accurate than the individual opinion of each specialist. This method can be recommended for obtaining qualitative assessments and rankings - for example, for comparing several projects according to their degree of compliance with a given criterion.

Expert judgment involves creating a mind that has greater capabilities than the individual. The source of the superpowers of multimind is the search for weak associations and assumptions based on the experience of an individual specialist. The expert approach has great potential for solving problems that cannot be solved in the usual analytical way:

Selecting the best solution option among the available ones.

Forecasting the development of the process.

Searching for possible solutions to complex problems.

Collective idea generation

- Application area. Obtaining a block of ideas for forecasting and decision making.

- Purpose, tasks to be solved. Determination of the entire possible range of development options for the managed object. Determination of an alternative range of factors affecting the forecast object. Obtaining a development scenario for the control object

- Features of application. Synthesis of the forecast object, multifactor analysis of events from the factors determining this event.

Morphological analysis

- Application area. When there is a small amount of information about the problem being studied, to obtain systematization of all possible solutions.

- Purpose, tasks to be solved. Forecasting the possible outcome of basic research. When opening new markets, creating new needs.

- Features of application. Structural relationships between objects, phenomena and concepts. Universality presupposes the use of the complete body of knowledge about an object. A necessary requirement is the complete absence of preliminary judgments. Contains the following stages: problem formulation; parameter analysis; construction of a “morphological box” containing all solutions; exploring all solutions.

Forecasting by analogy

- Application area. Resolving situations that are familiar to decision makers.

- Purpose, tasks to be solved. Solving situational management problems.

- Features of application. Using the method in the presence of analogues of objects and processes. Application of the method requires special skills.

Operations research

Operations Research (OR) is a discipline that deals with the development and application of methods for finding optimal solutions based on mathematical modeling, statistical modeling and various heuristic approaches in various areas of human activity. Sometimes the designation mathematical methods of operations research is used. Here are some examples of challenges that EOs have to face:

The knapsack problem

The traveling salesman problem

Transport task,

Container packing problem

Dispatch tasks such as Open Shop Scheduling Problem, Flow Shop Scheduling Problem, Job Shop Scheduling Problem, etc.

A characteristic feature of operations research is a systematic approach to the problem and analysis. The systems approach is the main methodological principle of operations research. It is as follows. Any problem that is solved must be considered from the point of view of its impact on the criteria for the functioning of the system as a whole. It is characteristic of operations research that with each problem solved, new problems may arise. An important feature of operations research is the desire to find the optimal solution to a given problem (the principle of “optimality”). However, in practice, such a solution cannot be found for the following reasons: 1) the lack of methods that make it possible to find a globally optimal solution to the problem; 2) limited existing resources (for example, limited computer time), which makes it impossible to implement precise optimization methods. In such cases, they are limited to searching not optimal, but rather good, from a practical point of view, solutions. We have to look for a compromise between the effectiveness of solutions and the costs of finding them. Operations research provides a tool for finding such trade-offs.

AI is closely related to management science, systems analysis, mathematical programming, game theory, optimal decision theory, heuristic approaches, metaheuristic approaches and artificial intelligence methods such as constraint satisfaction theory and neural networks.

Operations usually refer to purposeful, controlled processes. Their nature can be different - it can be military operations, production processes, commercial events, administrative decisions, etc., etc., etc., etc... What’s interesting is that these operations (completely dissimilar in nature ) can be described by the same mathematical models (!); moreover, the analysis of these models allows us to better understand the essence of a particular phenomenon and even predict its further development.

The basic method of operations research is a systematic analysis of operations, as well as an objective comparative assessment of the potential results of these actions.

So, for example, increasing production at a plant requires the simultaneous and interrelated solution of a large number of individual problems:

reconstruction of the enterprise;

ordering equipment, raw materials and materials;

preparation of the sales market;

technology optimization;

changing the operational production planning and dispatching system;

organizational restructuring, etc.

When analyzing the potential results of decisions made, it is necessary to take into account such components as uncertainty, randomness and risk. Such problems are solved by specialists in the fields of economics, mathematics, statistics, engineering, sociology, psychology, etc.

Thus, among the specific features of operations research, one can highlight the interdisciplinary nature.

AI is used mainly by large Western companies in solving production planning (controlling) problems

Logistics, marketing) and other complex tasks. The use of artificial intelligence in economics makes it possible to reduce costs or, to put it differently, to increase the productivity of an enterprise (sometimes several times!). IO is actively used by the armies and governments of many developed countries to solve complex problems of supplying armies, promoting armies, developing new types of weapons, developing war strategies, developing interstate trade mechanisms, forecasting developments (for example, climate), etc. Solving complex problems of increased importance is produced using AI methods on supercomputers, but development is carried out on simple PCs. AI methods can also be used in small enterprises using a PC.

Operations research is carried out mainly with the aim of providing a preliminary quantitative justification for the solutions used, since they are complex and involve high costs. Solutions are implemented in various ways or so-called strategies/alternatives. Operational research also provides a comparison of possible options for organizing an operation, allows one to assess the possible influence of particular factors on the result, identify vulnerable areas, that is, those components of the system, the improper functioning of which can have a direct negative impact on the success of the operation, etc.

From the above, the basis of the tasks of operations research seems obvious, which is expressed in the search for ways to optimally use available resources to achieve a certain goal.

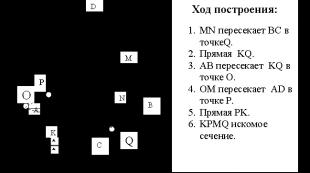

Rice. 1. Types or techniques of modeling.

Material methods include those modeling methods in which the research is carried out on the basis of a model that reproduces the basic geometric, physical, dynamic and functional characteristics of the object being studied.

Ideal modeling is fundamentally different from subject modeling, which is based not on a material analogy of an object and a model, but on an ideal, conceivable analogy. Ideal modeling is theoretical in nature.

Physical modeling is usually called modeling, in which a real object is contrasted with its enlarged or reduced copy, which allows research (usually in laboratory conditions) using the subsequent transfer of the properties of the processes and phenomena being studied from the model to the object based on the theory of similarity.

An example of a physical model: planetarium in astronomy.

Analog modeling is based on the analogy of processes and phenomena that have different physical natures, but are described formally in the same way (by the same mathematical equations, logical circuits, etc.). The simplest example is the study of mechanical vibrations using an electrical circuit described by the same differential equations. Here, the oscilloscope, invented in the 50s of the last century, brought an invaluable service.

By intuitive we mean modeling based on an intuitive idea of the object of study that cannot be formalized or does not need it. In this sense, for example, the life experience of each person can be considered his intuitive model of the world around him.

Sign modeling is modeling that uses sign transformations of any kind as models: diagrams, graphs, drawings, formulas, sets of symbols, etc., as well as a set of laws by which you can operate with selected sign formations and their elements.

Game models

A business game is a simulation model consisting of a sequence of a number of interconnected real situations and symbolic actions of participants, defined by the goals and given rules of the game. Business games are used mainly for processing and decision making.

Main directions and methods of forecasting and modeling in management

Management (from English management, from the main English manage, from Italian maneggiare - handle a tool, from Latin manus - hand) is a function of an organization, which consists in coordinating the efforts of a group of people to achieve set goals with effective and efficient use available resources.

Management (philosophy) is the activity of a subject to change an object to achieve a certain goal. Management (in an organization) is synonymous with the concept of management. Namely, the processes of planning, control over execution, optimization, organization of processes, including possible changes in structure, motivation of performers. It is often said that management is a function of an organization (institution).

Forecast (from the Greek πρόγνωσις - foresight, prediction) - predicting the future using scientific methods or the result of the prediction itself.

A forecast is a scientific model of a future event, phenomena, etc.).

Forecasting, forecast development; in a narrow sense - a special scientific study of specific prospects for the development of a process.

Forecasting is united by a single goal: determining the nature of the process in the future. Many methods for solving the forecasting problem have one common idea: discovering connections between the past and the future, between information about the process in a controlled period of time and the nature of the process in the future. The accuracy of prediction will depend on how accurately the relationships being studied are described.

Forecasting is one of the most important human activities today. Even in ancient times, forecasts allowed people to calculate periods of drought, dates of solar and lunar eclipses and many other phenomena.

With the advent of computer technology, forecasting received a powerful impetus for development. One of the first uses of computers was to calculate the ballistic trajectory of projectiles, that is, in fact, to predict the point at which the projectile would hit the ground. This type of forecast is called a static forecast.

There are two main categories of forecasts: static and dynamic. The key difference is that dynamic forecasts provide information about the behavior of the object under study over any significant period of time. In turn, static forecasts reflect the state of the object under study only at a single point in time and, as a rule, in such forecasts the time factor in which the object undergoes changes plays a minor role.

Today, there are a large number of tools that allow you to make forecasts. All of them can be classified according to many criteria:

comparison table

| Tool name | Scope of application | Implemented models | Required user training | Ready for use |

| Microsoft Excel, OpenOffice.org | general purpose | algorithmic, regression | basic knowledge of statistics | requires significant improvement (implementation of models) |

| Statistica, SPSS, E-views | research | a wide range of regression, neural network | special mathematics education | boxed product |

| Matlab | research, application development | algorithmic, regression, neural network | special mathematics education | programming required |

| SAP APO | business forecasting | algorithmic | no deep knowledge required | requires significant modification (for business processes) |

| ForecastPro, ForecastX | business forecasting | algorithmic | no deep knowledge required | boxed product |

| Logility | business forecasting | algorithmic, neural network | no deep knowledge required | requires significant modification (for business processes) |

| ForecastPro SDK | business forecasting | algorithmic | basic knowledge of statistics required | programming required (integration with software) |

| iLog, AnyLogic, iThink, Matlab Simulink, GPSS | application development, modeling | imitation | special mathematics education required | programming required (for the specifics of the area) |

Forecasting success depends on the following conditions: the volume and quality of information about the predicted process, the control object; the correctness of the formulation of the forecasting problem and the validity of the choice of method for solving it; availability of necessary computing facilities and computing apparatus in accordance with the chosen method. Without these conditions, forecasting may become impossible. The most important of them is the formulation of the problem, since it determines the requirements for the volume and quality of information, the mathematical apparatus and the accuracy of the forecast. Information about the predicted object (process) is drawn from the results of activity monitoring and statistics.

Modern forecasting technologies are based on the use of various mathematical theories: functional analysis, series theory, extrapolation and interpolation theory, probability theory, mathematical statistics, theory of random functions and random processes, correlation analysis, pattern recognition theory. To justify the choice of a particular forecasting tool, it is necessary to be able to quantify its quality.

Sources of information for forecasts are verbal and written texts obtained in the process of communications between people or in the open press. To obtain the necessary information, individual private business structures organize industrial espionage. Information from the open press is obtained using the following techniques: structural and morphological; definitions of public activity; identifying groups of patent documents; analysis of indicators; terminological and lexical analysis.

For forecasting in practice, various quantitative and qualitative methods are used.

· (structured) Quantitative methods (techniques) are based on information that can be obtained by knowing the trends in changes in parameters or having statistically reliable dependencies characterizing the production activities of the control object. Examples of these methods are time series analysis, causal (cause-and-effect) modeling.

· (unstructured) Qualitative methods are based on expert assessments of specialists in the field of decision making, for example, methods of expert assessments, jury opinions (averaging the opinions of experts in relevant areas), consumer expectation models (customer surveys).

· (loosely structured) Mixed methods contain qualitative and quantitative elements with dominance, as a rule, of qualitative and uncertain components.

(To predict crime, depending on specific conditions, a wide variety of methods are used, both general scientific and specific scientific ones. The most widely used methods are the method of extrapolation, modeling, expert assessments; comparative methods and methods of social experimentation.)

Forecasting in decision making

The uncertainty of the external environment puts the organization in such conditions that when making decisions, forecasting becomes necessary.

Definition 1

Forecasting– this is the development of forecasts (scientifically based judgments about the future states of the object under study, development alternatives, life spans, etc.).

Forecasting when making decisions means assessing the prospects for the development of the situation that may arise after the implementation of the decision. Forecasting is based on an analysis of the current situation in the organization and in the external environment. The purpose of forecasting is to identify trends that impact the organization and the market. Depending on the area of consideration, forecasting is divided into the following types:

- economic(describe the general state of the economy for a certain period);

- technological(describe future technologies, innovations in terms of efficiency, labor intensity, cost-effectiveness, etc.);

- competitive(describe the strategy of competitors’ behavior in the market, their market share, sales level, new products, etc.);

- about the state of the commodity market(describe the market situation in terms of the influence of politics, economics, ecology, consumer income level, demographics, etc.);

- social(describes the attitude of consumers towards the organization, product).

Definition 2

Sources for making forecasts are information obtained from financial statements, statistical data, operational data, scientific and technical documentation, licenses, patents, external sources of information (mass media, Internet).

Main stages of forecasting are presented in the diagram.

Picture 1.

There are many types of forecasting; all existing methods are usually divided into three groups:

- quantitative;

- quality;

- informal.

Figure 2.

Quantitative methods include:

- mathematical methods (extrapolation, time series analysis, time series analysis),

- Causal modeling.

Qualitative methods are used when there is no complete information about the situation. The basis of this group of methods is expert assessments. These include:

- heuristic, expert methods;

- forecasting by analogy;

- logical forecasting;

- functional-logical forecasting.

Expert methods are applied in all categories of management. Experts are professionals in a particular field and evaluate a situation based on their experience and intuition.

Forecasting by analogy used very often. If there is an analogy between the current situation and the previous one, you can predict how the current situation will develop.

Informal methods forecasting is based on information that is collected in different ways: verbal, written, obtained as a result of espionage.

Modeling during decision making

Simulation of situations is a widely used method to help make management decisions. Modeling involves studying a problem by building a model, studying its properties and behavior. After a comprehensive analysis of the model, the information obtained is transferred to the real situation. A model is an abstract object that is brought into line with the situation being studied.

When making decisions, use the following types of modeling:

- conceptual (models are diagrams that reflect ideas about which variables in a situation are most significant for decision making and how they interact, what are the connections between them);

- mathematical (the situation is presented in the form of a formula, a set of mathematical symbols and expressions; such models are convenient for quantitative analysis, they show the influence of elements within the situation on the final decision);

- imitation (with the help of a computer, the algorithm of operation of complex systems or objects is reproduced in time, their behavior and constituent elements are imitated; at the same time, the structure of the object is preserved, the sequence of processes is also observed).

The construction of any model includes several stages:

- Description of the object. This is a preliminary description that is as close as possible to real parameters. This stage is the basis for subsequent descriptions.

- Formalization of the object. Based on the description, the most important characteristics of the object that affect its operation are identified. Then the controllable parameters and those that cannot be controlled are determined. A system of constraints is identified, a diagram or mathematical function is constructed. Thus, the verbal description is replaced by an abstract (formal) and ordered one. 3. Adequacy check. Calculations are carried out, and based on their results, a decision is made on whether to apply the model in practice or to adjust the model.

- Adjustment. Information about the object is clarified and the parameters of the abstract model are adjusted. Then the adequacy assessment is carried out again.

- Optimization. While maintaining the adequacy parameters, they try to simplify the model. In this way, you can get a simpler model, but working on the same principles. The form of the model changes, but not the content. Main indicators for optimization: resource costs, time for research, time to make a decision using the model.

The experience of state regulation of various sectors of the national economy (including the social sphere) indicates that it should be based on systematic scientific planning and forecasting, which allows, based on the information received about the past and present state of the economy, to suggest alternative ways of its development in the coming period .

The development of forecasting methodology took place in the process of systematized scientifically based planning and forecasting of industry development. Modeling and forecasting methodology allows, based on the analysis of retrospective data, exogenous and endogenous connections of passion, to derive judgments of a certain reliability regarding its future development.

Currently, there are methods of expert assessment, logical methods of modeling and forecasting, methods of input-output balance, mathematical, econometric and simulation methods of modeling.

Expert methods are based on information supplied by specialist experts in the process of systematized procedures for identifying and summarizing opinions. Expert forecasting methods have proven themselves well in cases where it is impossible to take into account the influence of many factors due to the significant complexity of the forecast object, in the presence of a high degree of uncertainty in the information available in the forecast database, or in the absence of information about the forecast object at all.

Expert methods include round table or commission methods, collective generation of ideas, or brainstorming, Delphi, expert classification method and some others.

The main disadvantages inherent in expert assessment methods :

Labor intensity of organizing examinations;

- vagueness of judgments due to fear of responsibility for them;

- influence of interpersonal relationships;

- compliance with obvious or hidden pressure from management;

- the desire to simplify complex multi-criteria tasks;

- insufficient orientation in related areas;

- inability to predict converging (intersecting) paths of development and (or) changes in competing systems;

- the difficulty of presenting estimates in a form that meets the task;

- extrapolation of past experience without comprehensive consideration of emerging and expected changes;

- the impossibility of building a holistic model of the problem; the structure and cause-and-effect relationships of the model are also not revealed with this approach.

Collective expert assessments are modern scientific methods and are widely used in forecasting. A natural area of their application is the forecast of socio-economic development of the industry. In conditions of uncertainty and instability in the development of the socio-economic system of Russia, methods of expert assessments become of great importance.

Among logical methods The most widely used methods are the method of historical analogies and the method of developing scenarios.

Method of historical analogies effective in determining development paths based on constructing analogies with patterns that have already taken place in history. This method is unlikely to be used in an unstable economic situation.

Development scenario development method , which combines qualitative and quantitative approaches can now be effectively used.

A scenario is a model of the future that describes the possible course of events indicating the probabilities of their implementation . The scenario identifies the main factors that must be taken into account and indicates how these factors might affect the hypothesized events.

As a rule, several alternative scenarios are compiled. The most likely scenario is considered as the base one, on the basis of which decisions are made.

Using the scenario analysis method in its pure form, without computer analysis, has one very big drawback - the results of certain proposed development scenarios are predicted and assessed by an expert, based on his understanding of the problem and ability to assess the impact of the proposed course of events on the final result, but this does not add trust this method.

Therefore, a promising development of this method has recently become its use in combination with methods such as mathematical and simulation modeling, which makes it possible to evaluate the result of the proposed sequence of actions and events using appropriate models.

The simplest type among mathematical forecasting models are trend models in which the approximating function is selected based on the best match with the available data. A trend model is a mathematical model that describes the change in a predicted or analyzed indicator only depending on time .

However, this approach does not take into account possible changes in the cause-and-effect relationships between model parameters. Therefore, it can only be used for forecasting for a relatively short period, during which one can assume the constancy of the existing conditions of economic development.

The main disadvantages of trend models are :

The assumption that relationships found in historical data will persist in the future is, in some cases, erroneous;

- do not reveal structural changes in the development of the industry;

- problems arise with meaningful interpretation of the results;

- short forecasting period;

- cannot be used on small samples and sparse data.

One of the most important tools for analysis and forecasting of socio-economic systems is econometric modeling method , which is most effective in the case of systems with stable, stable development trends. In general, an econometric model is a system of regression equations and identities.

Modern methods of socio-econometric forecasting make it possible to construct a detailed system of structural equations and consider them as a whole as a model of the socio-economic system. However, while being a convenient forecasting tool, econometric models do not improve the accuracy of forecasting development turning points. They are more suitable for extrapolating existing development trends than for recognizing changes in them.

Another important disadvantage of forecasting based on econometric models is the high cost of such research, which requires the use of data banks, computers, and qualified specialists in the development and operation of these models. In addition to trend and regression models, the econometric modeling method uses factor and structural models.

Budget modeling of the social sphere

provides for obtaining reasonable forecast estimates characterizing the corresponding levels, dynamics, structure and relationships of budget revenues and expenses with each other and with general budget indicators.

The main problems of budget modeling are the lack of complete and reliable statistical information characterizing the real state of social sectors, as well as the low level of analysis and forecasting of dependencies between the volume of allocated budget funds and the dynamics of development of social sectors, incomplete assessments of the consequences and lost benefits due to the reduced approach to the development of the social sphere.

Complex systems, which include systems in the social sphere, are characterized by the presence of a huge number of feedback chains, positive and negative, between the elements of the systems influencing each other. Each given state of any element is determined by almost the entire history of the system’s existence, by the entire set of mutual connections of other elements that influence the state of this element.

Changes in states do not occur directly under the influence of one or several processes, not immediately, but with some delay. These circumstances do not allow us to use for research the well-developed analytical apparatus of modern mathematics, which is more suitable for studying linear dependencies inherent in simple systems.

That's why Dynamic computer modeling comes to the fore , which involves process automation based on modern information technologies. Simulation modeling is one of the most powerful tools used for the analysis and synthesis of complex systems. Recently, it has become widespread in the creation of systems for sustainable socio-economic development of regions, cities and entire sectors of the national economy.

Simulation models can take into account informal connections and characteristics of the predicted system, so they are able to most adequately reflect its development. However, it is the description of such non-formalized characteristics that poses the main difficulty in constructing simulation models.

The main problem for the successful construction of a dynamic model is the task of adequately determining the essence of the key elements of the system, the most important characteristics and parameters of their dynamics, as well as establishing connections between them that affect the dynamics of the development of the process.

In simulation modeling, there are several methodological approaches to describing complex systems :

Modeling of dynamic systems;

- discrete-event modeling;

- system dynamics;

- agent-based modeling, etc.

Analyzing traditional methods of forecasting and modeling complex socio-economic systems, we can say that the existing practice of forecasting and analytical activities does not allow obtaining a balanced forecast for the entire set of social decisions and economic indicators. Certain methods are applicable under certain conditions and have both advantages and disadvantages.

Thus, forecasting and subsequent planning from a management point of view means a set of works that prepare for making management decisions related to future events.

We are talking about reconciling the set goals and developing a set of measures necessary to achieve them within the framework of available opportunities and existing restrictions. Planning, therefore, is the systematic formation of the future of a system for a certain period of time.

So, When modeling and forecasting such complex processes that are observed in modern sectors of the national economy, the most effective are combined methods based on the integration of the simulation modeling method , as a system-forming method of decision-making in the study of socio-economic systems, as well as traditional forecasting methods .

Send your good work in the knowledge base is simple. Use the form below

Students, graduate students, young scientists who use the knowledge base in their studies and work will be very grateful to you.

Posted on http://www.allbest.ru/

Game theory. One of the most important variables on which the success of an organization depends is competitiveness.

Obviously, the ability to predict the actions of competitors means an advantage for any organization. Game theory is a method for modeling the impact of a decision on competitors.

Game theory was originally developed by the military so that the strategy could take into account the possible actions of the enemy. In business, game models are used to predict how competitors will react to price changes, new sales support companies, additional service offerings, modifications, and new product introductions. If, for example, management determines through game theory that competitors will not do the same if they raise prices, it may have to forgo this step to avoid being put at a competitive disadvantage.

Game theory is not used as often as other models. Unfortunately, real-world situations are often very complex and change so quickly that it is impossible to accurately predict how competitors will react to a change in a firm's tactics. However, game theory is useful when it comes to identifying the most important factors to consider in a competitive decision-making situation. This information is important because it allows management to consider additional variables or factors that may affect the situation, thereby increasing the effectiveness of the decision.

Queuing theory model. The queuing theory model or optimal service model is used to determine the optimal number of service channels in relation to the demand for them. Situations in which queuing theory models can be useful include people calling an airline to reserve a seat and obtain information, waiting in line for machine data processing, equipment repair technicians, a line of trucks to be unloaded at a warehouse, and bank customers waiting for an available teller. . If, for example, customers have to wait too long for a teller, they may decide to transfer their accounts to another bank. Likewise, if trucks have to wait too long to unload, they won't be able to complete as many trips in a day as they should. Thus, the fundamental problem is balancing the costs of additional service channels (more people to unload trucks, more cashiers, more clerks to pre-sell airline tickets) against the losses of suboptimal service (trucks will not be able to make an extra stop due to for delays in unloading, consumers go to another bank or turn to another airline due to slow service).

Queue models provide management with a tool to determine the optimal number of service channels to have to balance the costs of too few and too many service channels.

Inventory management models.

The inventory management model is used to determine the timing of placing orders for resources and their quantities, as well as the mass of finished products in warehouses.

Any organization must maintain some level of inventory to avoid delays in production and distribution.

The purpose of this model is to minimize the negative consequences of stockpiling, which is expressed in certain costs. These costs come in three main types: ordering, storage, and losses associated with insufficient inventory levels. In this case, the sale of finished products or the provision of services becomes impossible, and losses also arise from downtime of production lines, in particular due to the need to pay workers, although they are not working at the moment.

Maintaining a high level of inventory eliminates losses caused by shortages. Purchasing large quantities of materials needed to create inventories in many cases minimizes ordering costs, since the company can receive appropriate discounts and reduce the amount of paperwork. However, these potential benefits are offset by additional costs such as storage costs, reloading, interest payments, insurance costs, losses from damage, theft, etc.

Linear programming model. Used to determine the optimal way to allocate scarce resources in the presence of competing needs. Linear programming is usually used by headquarters specialists to resolve production difficulties.

Typical applications of linear programming in production management:

Integrated production planning (drawing up production schedules that minimize total costs, taking into account costs due to changes in interest rates, specified restrictions on labor resources and inventory levels);

Product range planning (determining the optimal product range, in which each type has its own costs and resource requirements);

Routing of product production (determining the optimal technological route for manufacturing a product, which must be sequentially passed through several processing centers, with each center operation characterized by its own costs and productivity);

Technological process control (minimizing the yield of chips when cutting steel, waste leather or fabric in a roll or panel);

Inventory regulation (determining the optimal combination of products in a warehouse or storage);

Production scheduling (drawing up schedules that minimize costs, taking into account the costs of maintaining inventories, paying for overtime work and external orders);

Product distribution planning (drawing up an optimal shipment schedule, taking into account the distribution of products between production plants and warehouses, warehouses and retail stores);

Determining the optimal location of a new plant (determining the best location by estimating the costs of transportation between alternative locations for the new plant and its supply and distribution locations);

Transport scheduling (minimization of costs of supplying trucks for loading and transport vessels to loading berths);

Distribution of workers (minimizing costs when distributing workers among machines and workplaces);

Materials handling (minimizing costs when routing the movement of materials handling equipment, for example, forklifts, between plant departments and delivering materials from an open warehouse to places of their processing on trucks of different carrying capacities with different fuel characteristics).

Simulation modeling. All of the models described above imply the use of simulation in a broad sense, since all are substitutes for reality. However, as a modeling technique, simulation specifically refers to the process of creating a model and its experimental application to determine changes in a real situation. The main idea of simulation is to use some device to simulate a real system in order to explore and understand its properties, behaviors and characteristics. A wind tunnel is an example of a physically tangible simulation model used to test the performance of aircraft and automobiles under development. Manufacturing and finance professionals can develop models to simulate the expected productivity and profit gains that will result from new technology or changes in the composition of the workforce.

Simulation is used in situations that are too complex for mathematical methods such as linear programming. This may be due to an excessively large number of variables, difficulty in mathematically analyzing certain relationships between variables, or a high level of uncertainty.

So, simulation is often a very practical way of substituting a model for a real system or natural prototype. Experiments on real or prototype systems are expensive and time consuming, and the relevant variables cannot always be controlled. By experimenting on a model of a system, it is possible to establish how it will react to certain changes or events, while it is not possible to observe this system in reality. If the results of experimentation using a simulation model indicate that the modification leads to improvement, the manager can make the decision to implement the change in the real system with greater confidence.

Economic analysis. Almost all managers perceive simulation as a modeling method. However, many of them never thought that economic analysis - obviously the most common method - is also a form of model building. Economic analysis includes almost all methods for assessing costs and economic benefits, as well as the relative profitability of an enterprise. A typical “economic” model is based on break-even analysis, a decision-making method that determines the point at which total revenue equals total costs, i.e. the point at which the enterprise becomes profitable.

The break-even production volume can be calculated for almost every product or service if the associated costs can be determined. This could be the number of seats on an airplane that must be occupied by passengers, the number of customers in a restaurant, or the sales volume of a new type of car.

In addition to modeling, there are a number of methods that can assist a manager in finding an objectively justified decision to select from several alternatives the one that most contributes to achieving goals.

Payment matrix. The essence of every decision made by management is the choice of the best of several alternatives according to specific criteria established in advance. The payment matrix is one of the methods of statistical decision theory, a method that can assist a manager in choosing one of several options. It is especially useful when a manager must determine which strategy will most contribute to achieving goals. A payoff represents a monetary reward or utility resulting from a specific strategy in combination with specific circumstances. If payments are presented in the form of a table (or matrix), we obtain a payment matrix. The words “in conjunction with the particular circumstances” are very important to understand when a payment matrix can be used and to assess when a decision made based on it is likely to be reliable. In its most general form, a matrix means that payment depends on certain events that actually occur. If such an event or state of nature does not actually occur, the payment will inevitably be different. In general, a payment matrix is useful when:

There are a reasonably limited number of alternatives or strategy options to choose between;

What may happen is not known with complete certainty;

The results of a decision depend on which alternative is chosen and what events actually take place.

In addition, the manager must be able to objectively assess the probability of relevant events and calculate the expected value of such probability. A leader rarely has complete certainty, but he also rarely acts in conditions of complete uncertainty. In almost all decision-making situations, a manager must evaluate the likelihood or possibility of an event. Probability can be determined objectively, just like a roulette player does when betting on odd numbers. The choice of its value may be based on past trends or the subjective assessment of the manager, who proceeds from his own experience of acting in similar situations.

Decision tree. This is a diagrammatic representation of a decision making problem. Like the payoff matrix, the decision tree allows the manager to consider different courses of action, relate financial results to them, adjust them according to the probability assigned to them, and then compare alternatives. The concept of expected value is an integral part of the decision tree method.

A decision tree can be built for complex situations where the results of one decision affect subsequent decisions. Thus, a decision tree is a useful tool for making sequential decisions.

Many of the assumptions a manager makes relate to future conditions over which the manager has little or no control. However, these types of assumptions are necessary for many planning operations. It is clear that the better a manager can predict external and internal conditions in relation to the future, the higher the chances of drawing up feasible plans.

Forecasting. It is a method that uses both accumulated experience and current assumptions about the future to determine it.

Types of forecasts:

Economic forecasts (used to predict the general state of the economy and sales volume for a specific company or for a specific product);

Forecasts of technology development (will allow us to predict the development of what new technologies can be expected, when this can happen, how economically acceptable they can be);

Forecasts of competition development (allow you to predict the strategy and tactics of competitors);

Forecasts based on surveys and research (provide the ability to predict what will happen in complex situations using data from many areas of knowledge. For example, the future market for automobiles can only be estimated by taking into account impending changes in the state of the economy, social values, political conditions, technology and environmental standards environment from pollution);

Social forecasting (currently practiced by only a few large organizations) is used to predict changes in people's social attitudes and the state of society.

Time series analysis. Sometimes called trend projection, time series analysis is based on the assumption that what happened in the past provides a fairly good approximation of the future.

This analysis is a method of identifying patterns and trends from the past and extending them into the future. This method of analysis is often used to assess the demand for goods and services, assess the need for inventories, forecast the sales structure characterized by seasonal fluctuations, or personnel requirements.

Causal (cause-and-effect) modeling. Causal modeling is the most sophisticated and mathematically complex quantitative forecasting method used today. It is used in situations with more than one variable. Causal modeling is an attempt to predict what will happen in similar situations by examining the statistical relationship between the factors under consideration and other variables.

When the amount of information is insufficient or management does not understand a complex method, or when a quantitative model is prohibitively expensive, management may resort to qualitative forecasting models. At the same time, forecasting the future is carried out by experts who are turned to for help. The four most common qualitative forecasting methods are jury opinion, aggregate marketer opinion, consumer expectation model, and expert pricing method.

Consumer expectation model. Forecast based on the results of a survey of the organization's clients. They are asked to evaluate their own needs in the future, as well as new requirements. By collecting all the data obtained in this way and making adjustments for over- or underestimation based on his own experience, the manager is often able to accurately predict aggregate demand.

Method of expert assessments. This method is a procedure that allows a group of experts to reach consensus. Experts fill out detailed questionnaires about the problem at hand. They also write down their opinions about her. Each expert then receives a compilation of the other experts' responses and is asked to reconsider his prediction and, if it does not agree with the others' predictions, is asked to explain why this is so. The procedure is usually repeated three or four times until the experts come to a consensus. It should be noted that the same object can be represented using different models. Let's consider the most common models of management decision making.

Multiplicative factor models. Their purpose is to develop characteristics of the influence of the main factors on the development of the management decision-making situation.

Descriptive models. This type is used to describe the properties and parameters of the decision-making process in order to predict its course in the future. Its effectiveness depends on the accuracy of the description of the patterns of functioning of the control object.

Normative models. The scope of their application is the management of the decision-making process, the formation of its essential elements. They assume the activity of all participants in the decision-making process in its modeling.

Inductive models. Their peculiarity is the development of a model based on generalization of observation results on individual particular facts considered important for the decision-making process.

Deductive models. This type of model is based on a simplified system of hypothetical situations. The model is formed through the transition from an abstract management situation to its concrete manifestation. managerial economic competitiveness

Problem-oriented models. The main task in developing a model is to adapt new modeling methods to specific management processes and situations.

Decision models. This type of models is developed taking into account the possibility of conducting experiments with them and using modern management technologies. The area of their application is solving the most important management problems. One is target models. They are used when there is one clearly defined goal. In this case, the goal can be either simple or complex, aggregated from several goals that are simple in structure. Multi-purpose models. The situation of their use is characterized by the presence of several independent goals that cannot be reduced to one comprehensive goal.

Single-period models. When forming them, they proceed from the fact that the totality of optimal individual decisions in individual periods of making management decisions as a whole for the entire period of solving a management problem also provides an optimal solution. However, it should be taken into account that winning at a single stage does not always lead to winnings over the entire decision-making period.

Multi-period models. These models assume a comprehensive solution to a management problem, taking into account the entire period of making a management decision.

Stochastic models. These models contain an element of uncertainty; the possible probabilistic distribution of the values of factors and parameters that determine the development of the situation is taken into account.

Deterministic models. Their peculiarity lies in the unambiguous determination of all factors influencing the development of the decision-making situation at the moment of their adoption. Being simplified models, they do not allow the element of uncertainty to be taken into account fully enough. At the same time, with their help many additional factors that are not available to stochastic models can be taken into account.

When choosing one or another model for making management decisions, it should be taken into account that not a single model can take into account all the factors of the external and internal environment of the organization that influence the formation and development of the problem situation. One of the significant factors in the internal environment of an organization is its established practice of developing and making management decisions.

Posted on Allbest.ru

Similar documents

Basic concepts and terms of modeling theory. Stages of the decision making and implementation process. Mathematical models and tools for making management decisions. Economic and mathematical modeling using the example of forecasting and planning.

test, added 03/24/2011

The concept of a management decision. Characteristics of modeling a problem situation. The process of developing solutions in complex situations. Basic and alternative concepts, classical and retrospective model of the management decision-making process.

course work, added 12/20/2010

Nature and classification of models in management. The use of business games and verbal descriptions in the process of making management decisions, their development using modeling. Features of the use of models in the field of service provision and personnel management.

course work, added 12/16/2012

course work, added 12/04/2004

The essence of modeling in management activities. Classification of models. Model of organization as an object of management. Features of modeling management processes. Verbal models. Math modeling. Practical management model.

course work, added 01/21/2008

Evaluation of a manager's performance. Decision making process. Identification and definition of the problem; search for information and solution alternatives; choice among alternatives. Operational, current and future solutions. Mathematical modeling of economic phenomena.

test, added 02/04/2011

Classification of management decisions. The concept of "risk" in the management of a modern organization. Risk management when developing management decisions. Risk assessment. Basic techniques and methods of risk management when making management decisions.

course work, added 11/19/2014

The concept of "model" and problem management mechanism. Classification and use of models of the management decision-making process. Development and adoption of management decisions under conditions of uncertainty and risk. Formalization of the problem using game theory methods.

course work, added 01/07/2011

Features of modeling in the process of making management decisions, the main stages of their development and implementation. Analysis of the nature of models in management, characteristics of types, areas of application; diagram of the decision-making process in the service and trade sectors.

course work, added 12/27/2011

Decision making as a component of the management function. Preparation of management decisions in modern organizations. Efficiency of the process of making and implementing management decisions using modeling elements in Magnit-NN LLC.